Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

In corporate finance, a discount rate is the rate of return used to discount future cash flows back to their present value. This rate is often a company’s Weighted Average Cost of Capital (WACC), required rate of return, or the hurdle rate that investors expect to earn relative to the risk of the investment.

Other types of discount rates include the central bank’s discount window rate and rates derived from probability-based risk adjustments.

A discount rate is used to calculate the Net Present Value (NPV) of a business as part of a Discounted Cash Flow (DCF) analysis. It is also utilized to:

In corporate finance, there are only a few types of discount rates that are used to discount future cash flows back to the present. They include:

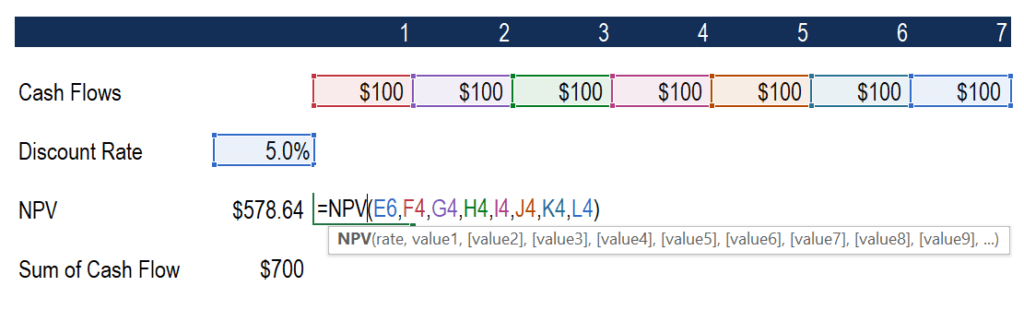

Below is a screenshot of a hypothetical investment that pays seven annual cash flows, with each payment equal to $100. In order to calculate the net present value of the investment, an analyst uses a 5% hurdle rate and calculates a value of $578.64. This compares to a non-discounted total cash flow of $700.

Essentially, an investor is saying “I am indifferent between receiving $578.64 all at once today and receiving $100 a year for 7 years.” This statement takes into account the investor’s perceived risk profile of the investment and an opportunity cost that represents what they could earn on a similar investment.

Below is an example from CFI’s financial modeling course on Amazon. As you can see in the screenshot, a financial analyst uses an estimate of Amazon’s WACC to discount its projected future cash flows back to the present.

By using the WACC to discount cash flows, the analyst is taking into account the estimated required rate of return expected by both equity and debt investors in the business.

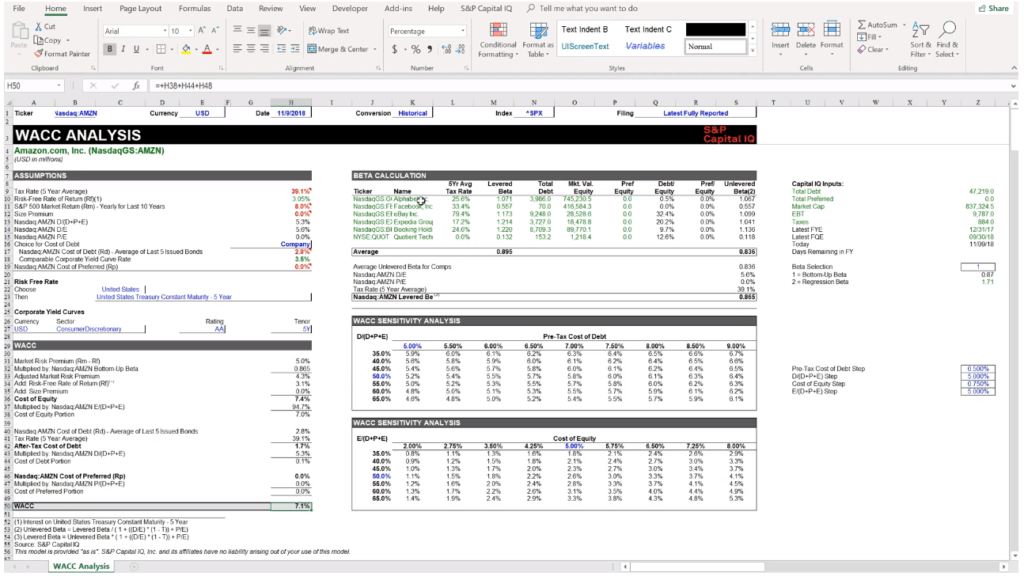

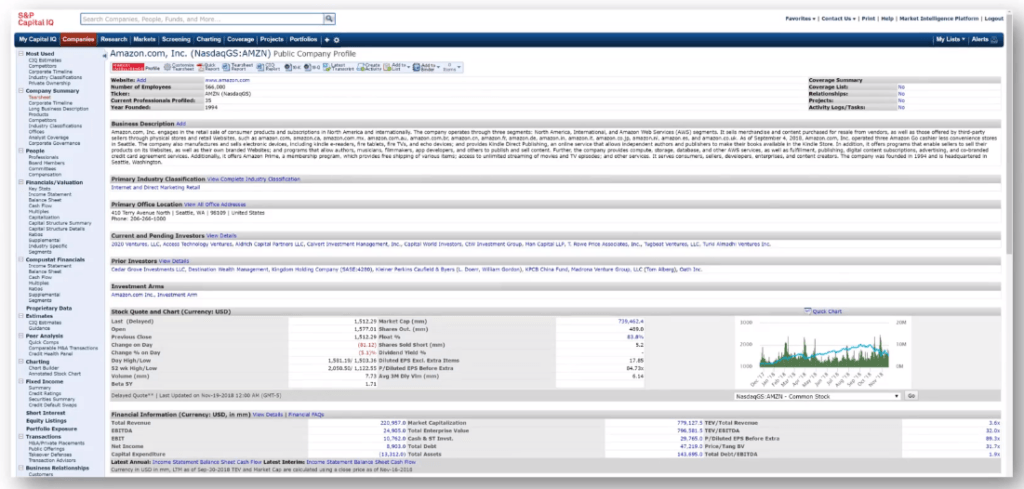

Below is a screenshot of an S&P Capital IQ template that was used in CFI’s Advanced Financial Modeling Course to estimate Amazon’s WACC.

While the calculation of discount rates and their use in financial modeling may seem scientific, there are many assumptions that are only a “best guess” about what will happen in the future.

Furthermore, only one discount rate is used at a point in time to value all future cash flows, when, in fact, interest rates and risk profiles are constantly changing in a dramatic way.

When using the WACC as a discount rate, the calculation centers around the use of a company’s beta, which is a measure of the historical volatility of returns for an investment. The historical volatility of returns is not necessarily a good measure of how risky something will be in the future.

Thank you for reading CFI’s guide to Discount Rate. To keep learning and advancing your career, the following CFI resources will be helpful:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.