We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Written by

Jess Ullrich

Edited by

Troy Segal

Troy Segal is a senior editor for Bankrate. She edits stories about mortgages and home equity, along with the finer financial points of owning and maintaining a home.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Bankrate logoFounded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Buying or selling a home is one of the biggest financial decisions an individual will ever make. Our real estate reporters and editors focus on educating consumers about this life-changing transaction and how to navigate the complex and ever-changing housing market. From finding an agent to closing and beyond, our goal is to help you feel confident that you're making the best, and smartest, real estate deal possible.

Bankrate logoBankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Bankrate logoYou have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

You’ve been searching for several months, and you’ve finally found a home you love in a great neighborhood. After negotiating with the seller, you settle on a price you both agree upon. You sign an agreement, put down a deposit, and eventually, you’re at the closing table concluding the transaction — or executing a purchase agreement, as they say in real estate lingo.

But what does a purchase agreement entail? What if there are certain terms and conditions involved in your home purchase?

Here’s everything you need to know about purchase agreements, what they include, and the timeline for creating one.

A purchase agreement, also referred to as a purchase contract, real estate sales contract, or real estate purchase contract, is an agreement between a buyer and seller that spells out the terms of a real estate transaction. As its name suggests, it’s a contract to purchase a property.

In addition to basic information like the property address and price, the document often outlines any contingencies that must have occurred before the sale is binding and specifies what rights the buyer has regarding seller obligations, and vice versa. For instance, if the sale is contingent on a satisfactory home inspection, that would be mentioned in the purchase agreement. Typically, contingencies come with a specific timeframe in which they must be met.

While similar in name to a purchase and sale agreement (PSA), the purchase agreement or contract is generally signed at the closing. “Typically, purchase and sale agreements are drafted earlier in the process. The buyer, seller or both must meet certain contingencies before a contract is drawn up and a transaction is finalized,” says Christine Finch Oleynick, Realtor with Keller Williams Luxury Realty. That being said, purchase agreement is sometimes used interchangeably with PSA.

The information outlined in a purchase contract can vary by state but it usually includes:

| Buyer and seller names | The legal names of all parties involved in the transaction, who have held or will hold title to the home. |

| Property information | The property address, square footage, and land plot information. |

| Price and financing information | The home’s final purchase price and the amount of the mortgage, if any, the buyer has taken out for the purchase. |

| Possession date | The possession date: when the buyer can take control of the property. |

| Closing date | The date the transaction is finalized, and the home officially changes hands. |

| Inclusions/exclusions | Any fixtures that the seller plans to leave behind, such as a washer/dryer or oven range, as well as any major items/furnishings they are taking with them. |

| Earnest money deposits | Sums indicating good faith the buyer has made, typically put into an escrow account. |

| Closing costs | Any closing costs required, as well as who pays them. |

| Contingencies | The contingencies that need to be met before a transaction is finalized. Common contingencies include home sale, home inspection, appraisal and financing contingencies. Contingencies often come with a set time frame. For instance, a buyer might need to secure financing by a certain date. |

While the purchase agreement provides a fairly comprehensive summary of a real estate transaction, you probably won’t see a specific breakdown of fees in this document.

For instance, if you want to see what’s included in your closing costs, you’d probably need to look at your settlement statement or closing statement, which you typically receive a few days before the closing. You’ll likely only see the final figure on the purchase agreement.

If a seller or buyer fails to meet a contingency within the time frame outlined, it’s possible to back out of the purchase. “But once contingencies are negotiated and met, the lawyer then drafts a purchase contract. After the buyer and seller sign that purchase contract, it’s a binding agreement,” Oleynick says, “However, it’s important to ask your Realtor or closing agent about the specific process in your state, as it can vary depending on where you live.”

Make no mistake: Despite the innocuous-sounding “agreement,” this is an official contract. It can be difficult for either party to back out of a purchase agreement (or even a PSA), and doing so could cost them money. Purchasers feeling buyers remorse will likely forfeit any earnest money deposits to the sellers, and second-guessing sellers could face legal action from the buyers.

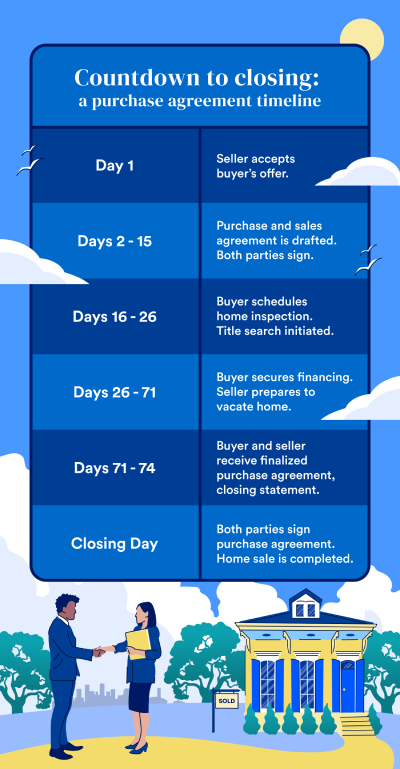

While the process and time needed to purchase a home can vary based on your state, here’s what you might expect: